how is capital gains tax calculated in florida

Income over 445850501600 married. Your primary residence can help you to reduce the capital gains tax that you will be subject to.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

. The calculator on this page is designed to help you estimate your. Income over 40400 single80800 married. Subtract that from the sale price and you get the capital gains.

Calculating capital gains on sale of home. Individuals and families must pay the following capital gains taxes. 15 hours agoUsing the short-term capital gains tax rates shown above the tax bill on your home sale would be 109736.

Depending on how long you hold your capital asset determines the amount of tax you will pay. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Capital gains tax can be one of the most discouraging aspects of a profitable real estate investment.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund. You can calculate capital gains taxes using IRS forms. Today the market value of the home is 300000.

Obtaining the amount requires you. In other words there is zero tax on the first 59250 in long-term capital gains. Hawaiis capital gains tax rate is 725.

When calculating your capital gain you must first calculate your basis in the capital asset before subtracting it from the sales proceeds to determine the tax owed. Take advantage of primary residence exclusion. It uses the date of the sale adjusted basis.

There is currently a bill that if passed would increase the capital gains tax in. Calculating Capital Gains On Your Florida Home Sale In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis. If your mom passes on the home to you youll automatically get a stepped-up basis.

500000 of capital gains on real estate if youre married and filing. The capital gains tax is based on that profit. To calculate and report sales that resulted in capital gains or losses start with IRS Form 8949.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year.

Heres how the capital gains tax currently works. The IRS typically allows you to exclude up to. Generally if you buy a home and live there as your primary residence.

Floridas capital gains tax rate depends upon your specific. Your basis is the purchase. Capital gains tax cgt breakdown.

Short-term capital assets are taxed at your ordinary income tax rate up to 37 for. Say your mothers basis in the family home was 200000. Nevada does NOT have a capital gains tax similar to federal income tax.

The amount that can be excluded. 250000 of capital gains on real estate if youre single. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year.

Ncome up to 40400 single80800 married. Short-term capital gains are treated as income and are taxed at your marginal income tax rate but long-term capital gains are taxed at a rate of 0 15 or 20 depending on your total income. The long-term capital gains tax rate is 0 15 or 20 depending on your.

That applies to both long- and short-term capital gains. At the federal level and in some states these are taxed at. Long-term capital gains taxes on the other hand apply to capital gains made from investments held for at least a year.

Holding on to your home for at least a year would convert this to a. You can also add sales expenses like real estate agent fees to your basis. Florida has no state income tax which means there is also no capital gains tax at the state level.

The next 20750 are taxed at the 15 long-term capital gains bracket which is 3113 in long-term. Record each sale and. Capital Gains Tax.

When you sell your primary residence 250000 of.

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains On Selling Property In Orlando Fl

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Capital Gains Tax Calculator 2022 Casaplorer

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Real Estate Capital Gains Calculator Internal Revenue Code Simplified

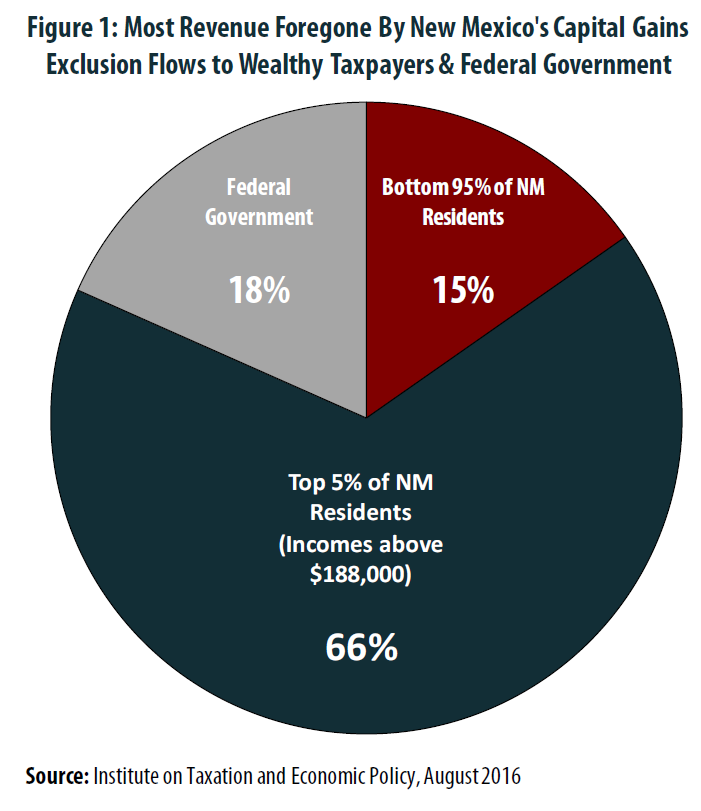

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is Capital Gains Tax And When Are You Exempt Thestreet

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Capital Gains Tax What Is It When Do You Pay It

How High Are Capital Gains Taxes In Your State Tax Foundation

Florida Real Estate Taxes What You Need To Know

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Income Types Not Subject To Social Security Tax Earn More Efficiently

![]()

What Is My Tax Rate For My Crypto Gains Cointracker

The Folly Of State Capital Gains Tax Cuts Itep

The States With The Highest Capital Gains Tax Rates The Motley Fool